The Executive Board of the Riksbank has decided to raise the repo rate by 0.25 of a percentage point to 1.0 per cent.

The Swedish economy is growing rapidly. On the other hand, the strength of the recovery in the United States and Europe remains uncertain. Inflationary pressures are low in Sweden, but are expected to increase as economic activity strengthens. In order to stabilise inflation close to the target of 2 per cent and attain normal levels of resource utilisation, the repo rate needs to be gradually raised. The Executive Board of the Riksbank has therefore decided to raise the repo rate by 0.25 of a percentage point to 1.0 per cent. However, due to the weak developments overseas, it is not deemed that the repo rate needs to be raised so much in the coming years.

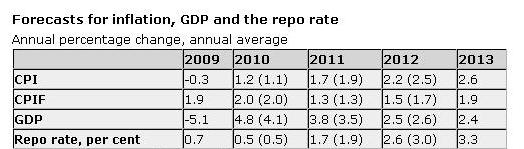

Source: Statistics Sweden and the Riksbank

Even if inflationary pressures in the Swedish economy are presently low due to the weak economic climate abroad, low labour costs for Swedish companies and a strengthening of the Swedish krona, they are expected to increase in tandem with the strengthening of economic activity in Sweden. In order to stabilise inflation close to the target of 2 per cent and attain a normal level of resource utilisation, the repo rate gradually needs to be increased towards more normal levels. Moreover, households’ debts have increased substantially in recent years. If debts continue to increase significantly faster than revenues over a longer period of time, there is a risk of imbalances building up in the Swedish economy.

As always, the forecasts made regarding the economy and monetary policy are based on the information currently available and new information further ahead may lead to changes in these forecasts. If international growth becomes weaker as a result of developments such as a slowdown of the recovery in the United States or a worsening of the fiscal policy problems in Europe, monetary policy may need to become more expansionary than in the main scenario. On the other hand, it cannot be ruled out that domestic demand in Sweden may be stronger than expected, in which case the interest rate may need to be increased further in the future.

Source: Riksbank

EUR 4.2538 zł

EUR 4.2538 zł USD 3.6396 zł

USD 3.6396 zł DKK 0.57 zł

DKK 0.57 zł SEK 0.3784 zł

SEK 0.3784 zł NOK 0.3584 zł

NOK 0.3584 zł